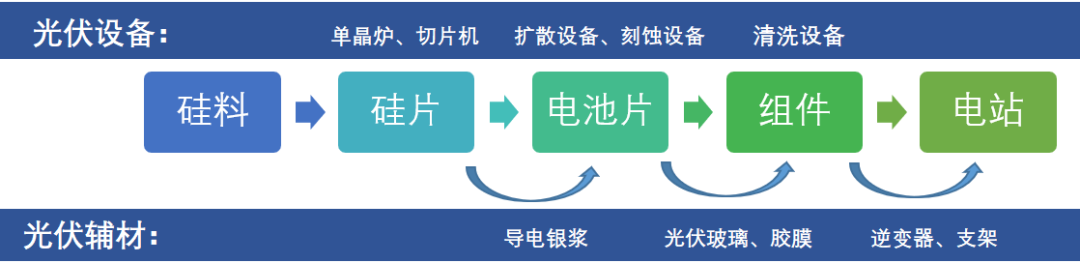

With the “Annual Report Season” almost coming to the end on April 30, A-share listed companies reluctantly or reluctantly handed out 2021 annual reports. For the photovoltaic industry, 2021 is enough to be recorded in the history of photovoltaics, because the competitions in the industry chain began to enter the white-hot stage in 2021. Overall, the PV industry chain consists of core segments such as silicon, silicon wafers, cells and modules, and secondary segments such as PV auxiliary materials and PV equipment.

The “grid parity” was realized for photovoltaic power generation that had been pursued for more than ten years at terminal photovoltaic power plants, which in turn puts forward more stringent requirements for the cost of the photovoltaic industry chain.

In the silicon segment of the industry chain upstream, there’s huge demand for green power due to carbon neutral, making the prices of silicon that is expanded at the slowest speed rise sharply, thus causing a huge impact on the original profit distribution of the industry chain.

In the silicon wafer segment, a new force of silicon wafers such as Shangji Automation is challenging the traditional silicon wafer manufacturers; in the cell segment, N-type cells begin to replace P-type cells.

All these intertwined events may make the investors feel confused. But at the end of annual reports, we can catch a glimpse of gains and losses of each PV company through the financial data.

This post will review the annual results of dozens of PV companies and break down core financial data into various segments of the industry chain in an attempt to answer the following two questions:

1. Which segments of PV industry chain saw profits in 2021?

2. How will the profits of the PV industry chain be distributed in the future? Which segments are suitable for layout?

Great profits of silicon promotes the development of silicon wafers, but cells saw slow business

In the main segments of the PV industry chain, we have selected the listed PV companies with clear financial data disclosure for the business segments of silicon - wafer - cell - module, and compared the revenue and weighted gross margin of different business segments of each company, so as to clearly reflect the profitability changes of each segment of the PV industry chain.

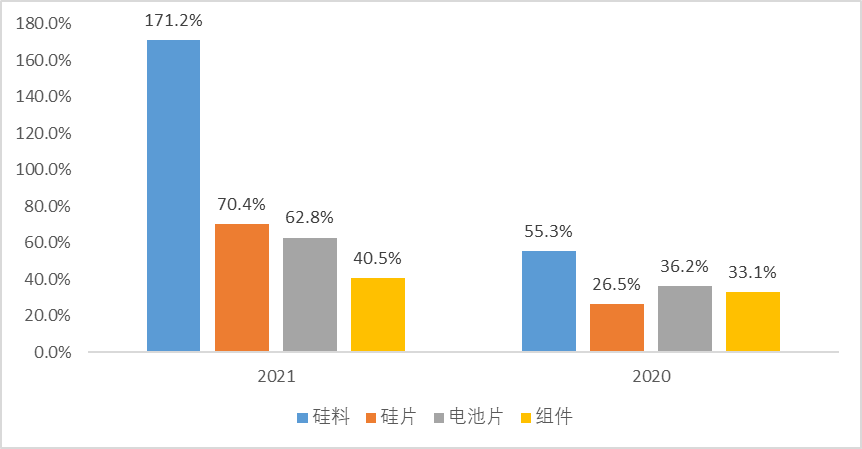

The revenue growth rate of main segments of PV industry chain is higher than the industry growth rate. According to CPIA data, the global new PV installed capacity was about 170GW in 2021, an increase of 23% year-on-year, while the revenue growth rate of silicon/wafer/cell/module was 171.2%/70.4%/62.8%/40.5% respectively, in a decreasing state.

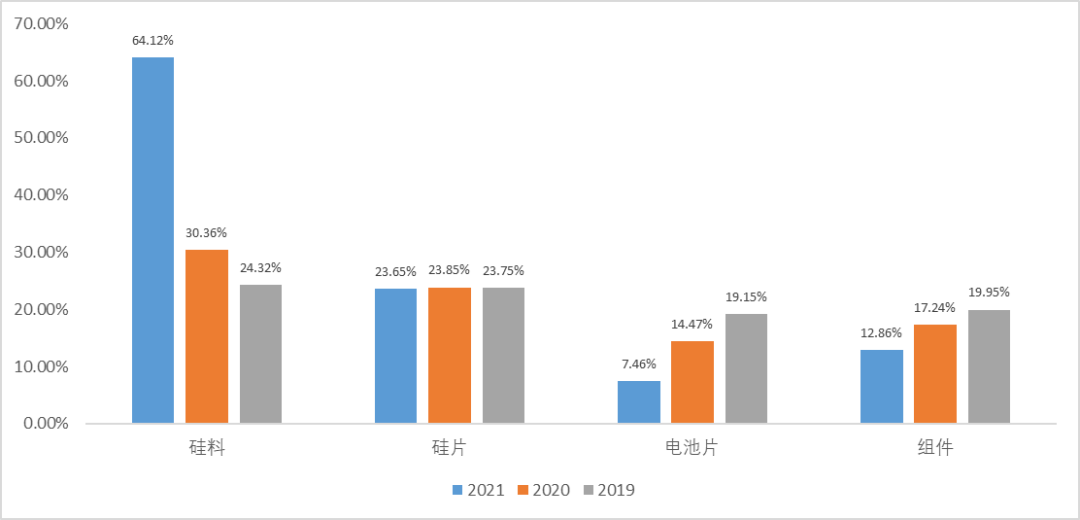

From the perspective of gross margin, the average selling price of silicon rose from 78,900/ton in 2020 to 193,000/ton in 2021. Benefiting from the significant price increase, the gross margin of silicon increased significantly from 30.36% in 2020 to 64.12% in 2021.

The wafer segment has shown strong resilience, with gross margins remaining at around 24% for the past three years, despite the sharp rise in silicon costs. There are two main reasons for the stable gross margin of the wafer segment: First, the wafer is in a relatively strong position in the industry chain and has a strong bargaining power over downstream cell manufacturers, which can shift most of the cost pressure. Second, Zhonghuan Semiconductor, one of the important output side of silicon wafers manufacturers, has significantly improved its profitability after the completion of hybrid reform and promotion of 210 silicon wafers, thus playing a stabilizing role in the gross margin of this segment.

The cell and module are the real victim of the current wave of silicon price increases. The gross margin of the cell plummeted from 14.47% to 7.46%, while the gross margin of the module dropped from 17.24% to 12.86%.

The reason for the better performance of the gross margin of the module segment compared to the cell segment is that the core module companies are all integrated companies and have no middlemen to earn the difference, so they are more resistant to pressure. Aikosolar, Tongwei and other cell companies need to purchase silicon wafers from other companies, so their profit margins are obviously squeezed.

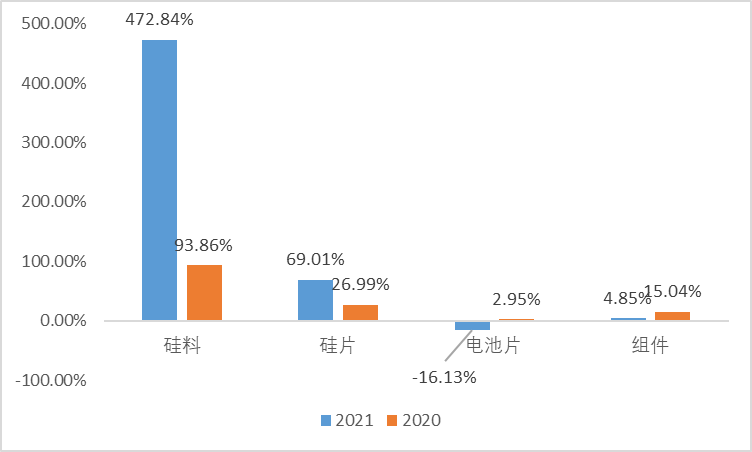

Finally, from the gross profit (operating income * gross margin) changes, the fate gap between different segments of photovoltaic industry chain is more obvious.

In 2021, the gross profit of the silicon segment grew by as much as 472%, while the gross profit of the cell segment declined by 16.13%.

In addition, we can see that although the gross margin of the wafer segment has not changed, the gross profit has increased by nearly 70%. In fact, if we look at it from a profit perspective, silicon wafers actually benefit from the silicon price increase wave.

Photovoltaic auxiliary material margins are damaged, but equipment vendors remain strong

We adopted the same method in the auxiliary materials and equipment of photovoltaic industry chain. In the listed photovoltaic companies, we selected relevant bids, and analyzed the profit situation of the corresponding segments.

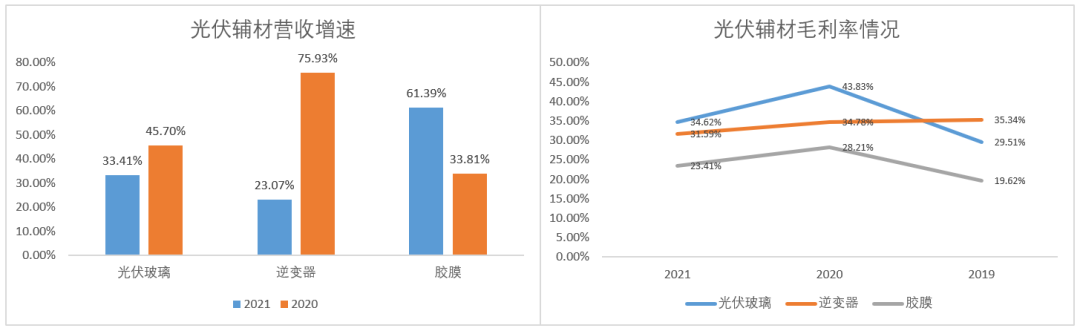

Each company saw decline in the gross margin of photovoltaic auxiliary materials segment, but all can achieve profitability. Overall, PV glass and inverters suffered from increasing revenue without increasing profit the most, while the profit growth rate of PV film was relatively more excellent.

The financial data of each equipment vendor is very stable in PV equipment segment. In terms of gross margin, the weighted gross margin of each equipment vendor increased from 33.98% in 2020 to 34.54% in 2021, almost unaffected by various disputes in the main PV segment. In terms of revenue, the overall operating income of the eight equipment vendors as a whole also increased by 40%.

The overall performance of the PV industry chain near the upstream of silicon and wafer segment profitability is relatively good in 2021, while the downstream cell and module segment is subject to the strict cost requirements of the power station, thus reducing profitability.

Photovoltaic auxiliary materials such as inverters, photovoltaic film, and photovoltaic glass are targeted at the industry chain downstream customers, so profitability in 2021 was affected to varying degrees.

What changes will happen to the PV industry in the future?

Skyrocketed silicon price is the main reason for the changes in the profit distribution pattern of the PV industry chain in 2021. So, when will silicon prices fall in the future and what changes will occur in the PV industry chain after the decline have become the focus of investors’ attention.

1. Silicon price judgment: The average price remains high in 2022, and starts to plunge in 2023.

According to the data of ZJSC, the global silicon effective capacity in 2022 is about 840,000 tons, which is about 50% year-on-year growth and can support about 294GW of silicon wafer demand. If we take into account the capacity allocation ratio of 1.2, the effective silicon capacity of 840,000 tons in 2022 can meet about 245GW of installed PV capacity.

2. Silicon wafer segment is expected to start price war in 2023-2024.

As we know from the previous review of 2021, silicon wafer companies are essentially benefiting from this wave of silicon price hikes. Once silicon prices go down in the future, wafer companies will inevitably lower their wafer prices due to pressure from peers and downstream segments, and even if gross margins remain the same or increase, gross profit per GW will decline.

3. Cells and modules will recover from dilemma in 2023.

As the biggest “victim” of the current wave of silicon price increases, the cell and module companies silently bore the cost of the entire industry chain pressure undoubtedly most hope that silicon prices plummet.

The overall situation of the PV industry chain in 2022 will be similar to that of 2021, and when silicon capacity is fully released in 2023, the silicon and wafer segments will most likely experience a price war, while the profitability of the downstream module and cell segments will start to pick up. Therefore, cell, module and integration companies in the current PV industry chain will be more worthy of attention.

Post time: Jun-10-2022